Anti-Corruption & Fraud

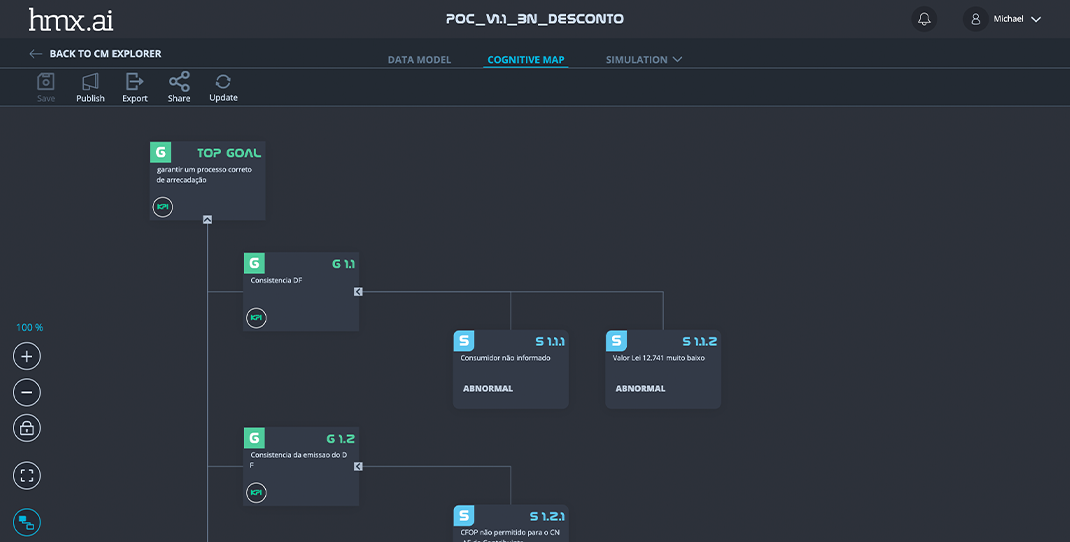

Accelerating detection of fraud with CRexTM explainable AI

Our XAI solutions go beyond traditional pattern matching, profile segmentation and rules processing to detect fraud, providing explainability that makes AI actionable in real-world compliance.